All Categories

Featured

Table of Contents

- – What is the best Level Death Benefit Term Life...

- – How does Fixed Rate Term Life Insurance work?

- – How can I secure Tax Benefits Of Level Term L...

- – What are the benefits of Level Term Life Insu...

- – What types of What Is Level Term Life Insura...

- – Where can I find Best Level Term Life Insura...

Premiums are normally less than entire life policies. With a degree term plan, you can pick your protection quantity and the policy length. You're not secured into a contract for the rest of your life. Throughout your plan, you never have to bother with the costs or death advantage amounts altering.

And you can't pay out your policy throughout its term, so you won't obtain any monetary benefit from your past coverage. Similar to other types of life insurance coverage, the expense of a level term policy relies on your age, coverage needs, employment, way of living and health. Usually, you'll locate a lot more inexpensive coverage if you're younger, healthier and less risky to insure.

Because degree term premiums stay the very same throughout of insurance coverage, you'll recognize exactly how much you'll pay each time. That can be a huge help when budgeting your costs. Level term protection likewise has some versatility, enabling you to personalize your policy with extra features. These frequently can be found in the type of bikers.

You might have to fulfill details conditions and certifications for your insurance company to enact this biker. On top of that, there may be a waiting duration of approximately 6 months before taking impact. There likewise might be an age or time frame on the protection. You can add a youngster cyclist to your life insurance policy plan so it additionally covers your youngsters.

What is the best Level Death Benefit Term Life Insurance option?

The death advantage is typically smaller sized, and coverage usually lasts up until your child transforms 18 or 25. This rider might be an extra economical method to help ensure your kids are covered as motorcyclists can often cover numerous dependents at once. As soon as your kid ages out of this protection, it may be feasible to transform the motorcyclist right into a brand-new plan.

When contrasting term versus permanent life insurance policy, it is essential to bear in mind there are a few various types. The most common kind of long-term life insurance policy is whole life insurance coverage, yet it has some vital distinctions contrasted to level term insurance coverage. Right here's a fundamental summary of what to think about when comparing term vs.

Entire life insurance policy lasts forever, while term protection lasts for a specific duration. The premiums for term life insurance are generally less than whole life protection. With both, the costs continue to be the same for the period of the plan. Whole life insurance policy has a cash money value part, where a section of the costs may expand tax-deferred for future needs.

How does Fixed Rate Term Life Insurance work?

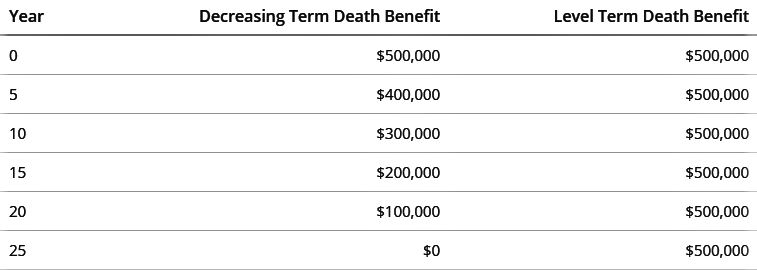

One of the main functions of degree term coverage is that your premiums and your death benefit do not change. You may have insurance coverage that starts with a death advantage of $10,000, which could cover a home loan, and after that each year, the fatality advantage will certainly lower by a set amount or percentage.

Due to this, it's usually a more economical type of level term coverage., however it might not be adequate life insurance coverage for your needs.

After picking a plan, complete the application. For the underwriting process, you might have to offer general personal, wellness, lifestyle and work information. Your insurance firm will certainly determine if you are insurable and the danger you might offer to them, which is mirrored in your premium expenses. If you're authorized, authorize the documentation and pay your very first premium.

You might desire to update your recipient information if you have actually had any significant life adjustments, such as a marital relationship, birth or separation. Life insurance coverage can occasionally feel difficult.

How can I secure Tax Benefits Of Level Term Life Insurance quickly?

No, degree term life insurance policy doesn't have cash value. Some life insurance policy plans have an investment attribute that permits you to develop money worth in time. Level term life insurance coverage. A portion of your costs repayments is alloted and can earn interest in time, which grows tax-deferred throughout the life of your coverage

These policies are commonly substantially more pricey than term protection. You can: If you're 65 and your protection has run out, for example, you may want to buy a new 10-year degree term life insurance coverage plan.

What are the benefits of Level Term Life Insurance Companies?

You might have the ability to convert your term protection right into an entire life plan that will certainly last for the rest of your life. Numerous sorts of degree term policies are convertible. That means, at the end of your protection, you can transform some or every one of your policy to entire life coverage.

Level term life insurance policy is a plan that lasts a collection term generally in between 10 and 30 years and features a level survivor benefit and degree premiums that stay the very same for the whole time the policy is in impact. This implies you'll recognize precisely just how much your repayments are and when you'll need to make them, allowing you to budget appropriately.

Level term can be a terrific choice if you're wanting to purchase life insurance protection for the very first time. According to LIMRA's 2023 Insurance Measure Research, 30% of all grownups in the U.S. demand life insurance policy and do not have any sort of policy yet. Degree term life is foreseeable and affordable, that makes it among the most popular types of life insurance policy

A 30-year-old man with a comparable profile can expect to pay $29 each month for the exact same insurance coverage. AgeGender$250,000 insurance coverage quantity$500,000 coverage quantity$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Ordinary monthly prices are determined for male and female non-smokers in a Preferred wellness classification getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance plan.

What types of What Is Level Term Life Insurance? are available?

Rates might differ by insurance company, term, protection amount, health class, and state. Not all plans are available in all states. Rate image legitimate as of 09/01/2024. It's the least expensive type of life insurance policy for many people. Level term life is far more inexpensive than an equivalent whole life insurance plan. It's very easy to manage.

It permits you to spending plan and prepare for the future. You can conveniently factor your life insurance policy into your budget plan due to the fact that the costs never ever change. You can intend for the future just as quickly due to the fact that you recognize exactly just how much cash your enjoyed ones will obtain in the event of your absence.

Where can I find Best Level Term Life Insurance?

In these cases, you'll normally have to go via a brand-new application process to get a much better price. If you still need insurance coverage by the time your level term life plan nears the expiration day, you have a couple of options.

Table of Contents

- – What is the best Level Death Benefit Term Life...

- – How does Fixed Rate Term Life Insurance work?

- – How can I secure Tax Benefits Of Level Term L...

- – What are the benefits of Level Term Life Insu...

- – What types of What Is Level Term Life Insura...

- – Where can I find Best Level Term Life Insura...

Latest Posts

Buy Funeral Cover Online

No Exam Instant Life Insurance

Affordable Funeral Insurance Plans

More

Latest Posts

Buy Funeral Cover Online

No Exam Instant Life Insurance

Affordable Funeral Insurance Plans